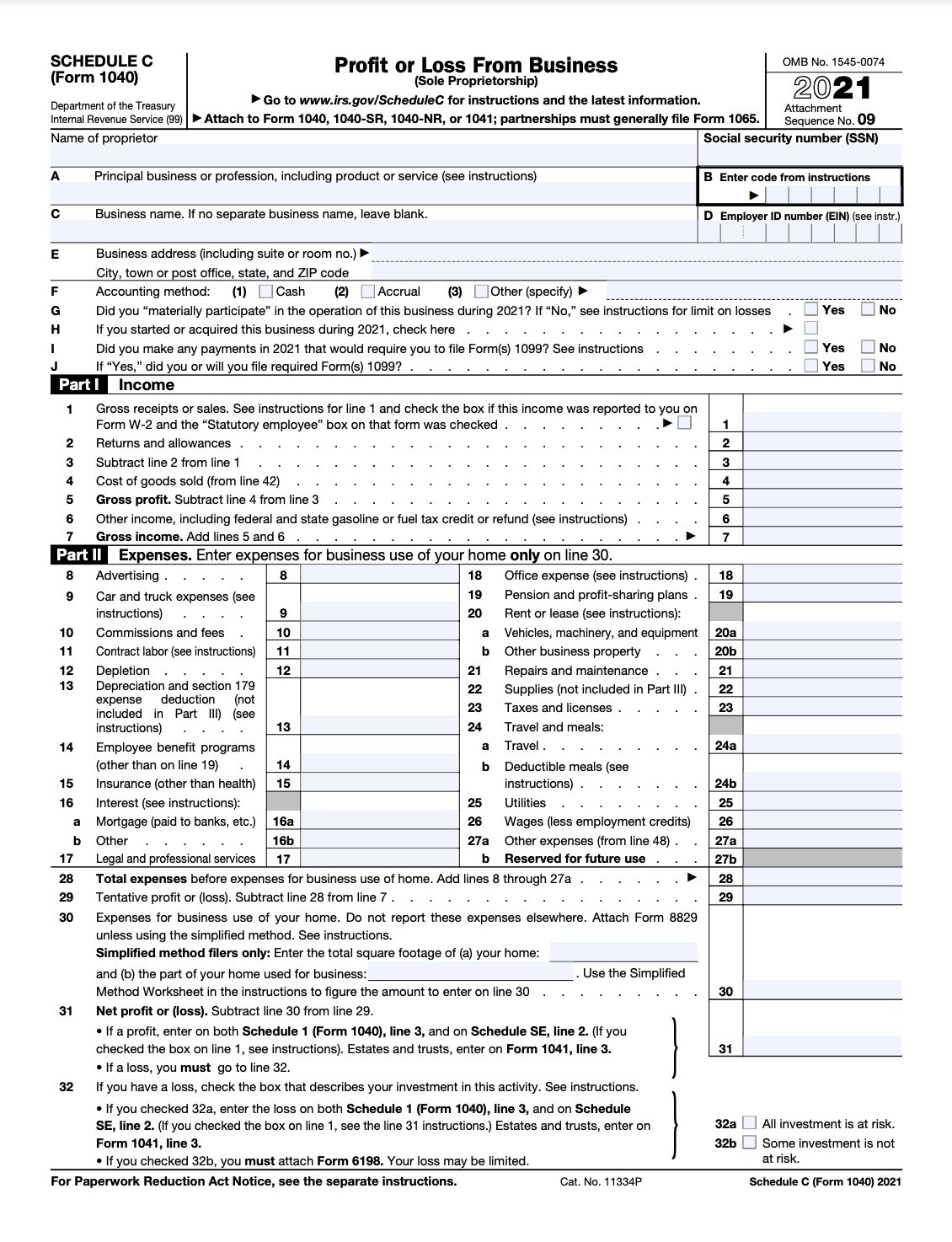

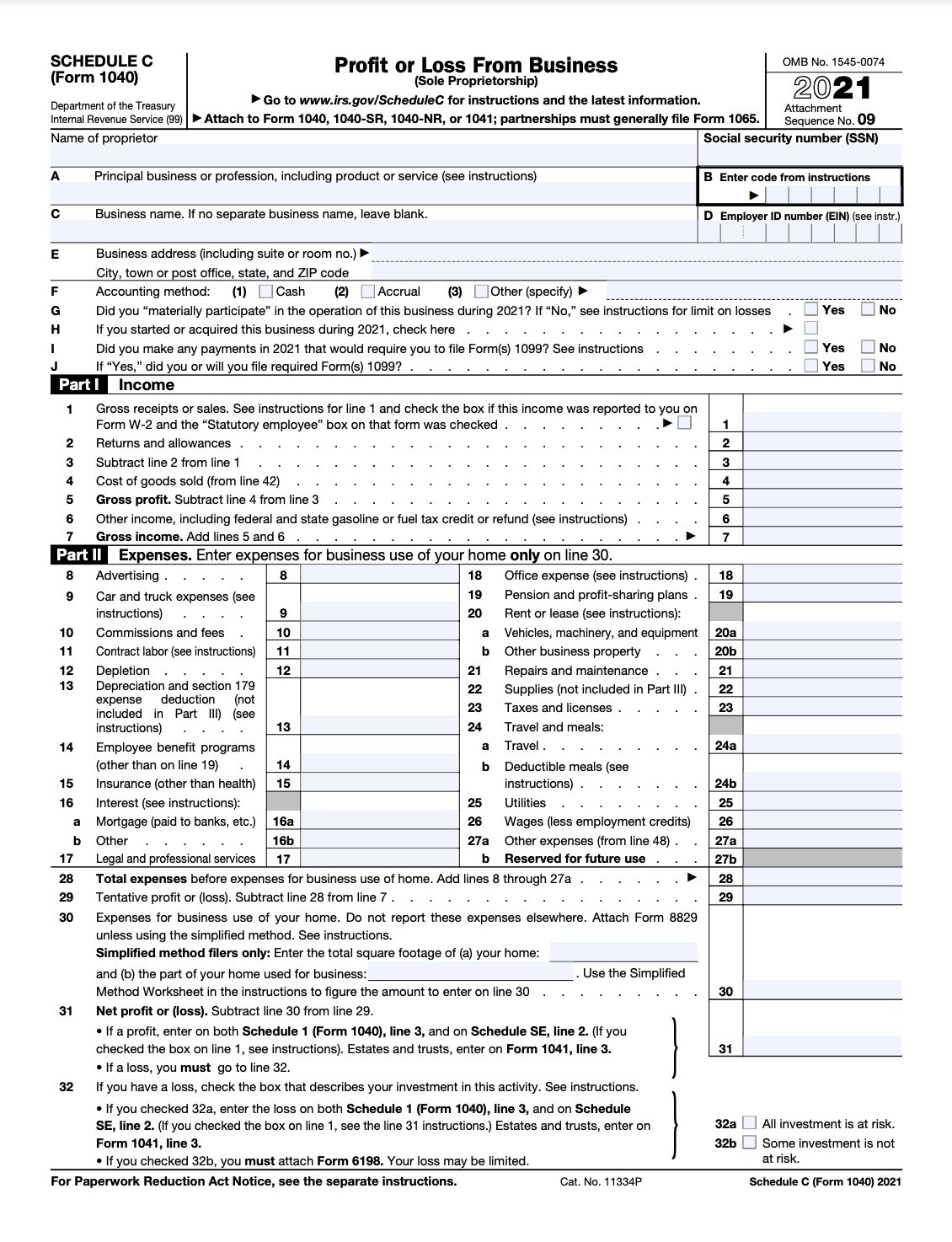

schedule c tax form meaning

Ad Schedule C is an addition to Form 1040 for business owners self-employers. Schedule C is the form that you use to report self-employment income.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

In other words it counts as self-employment income and you do have.

. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. What Do The Expense Entries On The Schedule C Mean Support Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition Form 2106 Employee Business Expenses. The profit or loss that.

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. The IRS Schedule C Profit or Loss from Business is a tax document that you submit with your Form 1040 to detail your businesss income and costs. An accounting method is chosen when you file.

This can encompass owning a digital or brick-and-mortar small business. The revenue is recorded even if cash has. Build Paperless Workflows with PDFLiner.

Form 1099-C is used to declare amounts of 600 or more that are forgiven or canceled by a lender or creditor including the abandonment of secured property or foreclosure. Whether a business owner uses Schedule E or Schedule C depends on the type of. To navigate back to your business.

See instructions for Line 1 and check the box if this income was reported to you on Form W-2 and the statutory employee. Edit Fill Sign Share Documents. In this segment well provide an overview of Form 1040 Schedule C Profit or.

On the other hand the accrual method accounts for revenue when it is earned and expenses goods and services when they are incurred. The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax. Its used to report profit or loss and to include this information in the owners.

Music playing music playing Hello everyone and welcome to Schedule C and Other Small Business Taxes. The resulting profit or loss is typically. Schedule E and Schedule C are both filed as part of the owners personal tax return.

1 Legal Form library PDF editor e-sign platform form builder solution in a single app. The Schedule C form calculates the net profit for independent contractors and small business owners. Schedule C - Accounting Method An accounting method is the method used to determine when you report income and expenses on your return.

Gross receipts or sales. Schedule C is the form used to report income and expenses from self-employment. Essentially both forms separately report your business earnings and deductions to arrive at your net.

Click Federal On the left of the screen 3. Ad Download Or Email Schedule C More Fillable Forms Register and Subscribe Now. Click Income Expenses on the top of the screen.

The profit is the amount of money you made after covering all. You will need to file Schedule C annually as an attachment to your Form 1040. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

Sign on and continue with your tax return 2.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Business Activity Code For Taxes Fundsnet

Indie Authors Should Consider Using Schedule C Tax Forms Irs Tax Forms Irs

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

What Is Schedule E What To Know For Rental Property Taxes

Business Activity Code For Taxes Fundsnet

Business Activity Code For Taxes Fundsnet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)